Nepal's Economic Trends: Insights from the Nine-Month Report by Nepal Rastra Bank

Nepal's Economic Trends: Insights from the Nine-Month Report by Nepal Rastra Bank

Macro Insights

Ideapreneur Nepal

Created on :

2024-05-12

Download our app for a smooth experience

Total Views:

69 views

Excited to know how Nepal's economy is doing?

The Nepal Rastra Bank's monthly report is like a guidebook for understanding Nepal's financial and economic health. It covers everything from inflation to remittance flows, foreign reserves to interest rates, making it a go-to resource for valuable information. Whether you're interested in tracking economic trends or staying up-to-date on economic and financial developments, this report provides all the information you need.

The Nepal Rastra Bank has just released its monthly report, covering data from the first nine months ending mid-April of FY 2023/24. This report suggests a noticeable improvement in the country's economic landscape.

Now, let's take a closer look at the diverse key factors essential for thoroughly assessing the overall health of our economy.

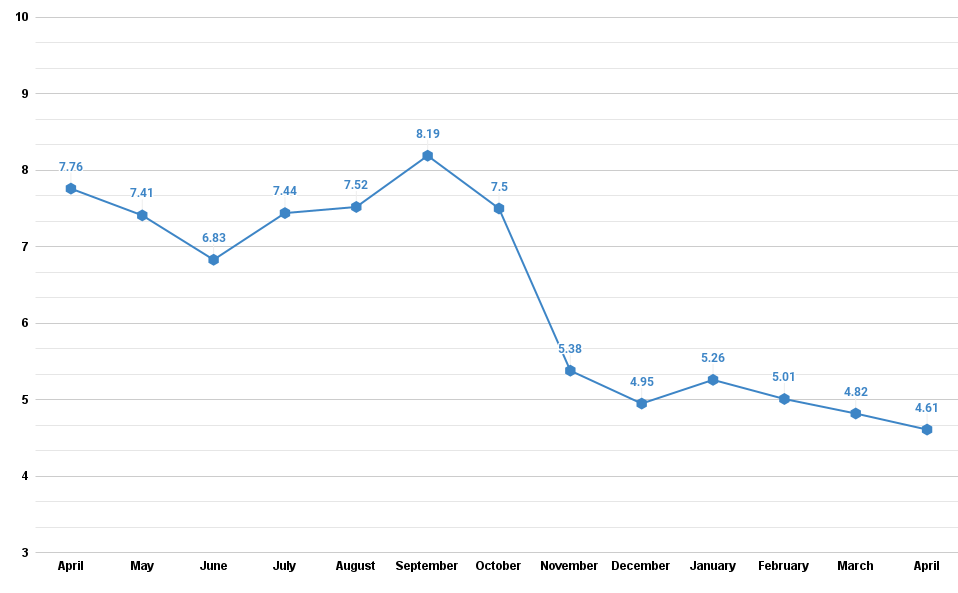

Consumer Price Inflation (CPI)

The inflation rate has dropped to 4.61%, down from the previous month's 4.82% and significantly lower than the 7.76% recorded a year ago. Importantly, inflation has consistently stayed within the government's targeted range of 6.5%, as outlined in the fiscal year budget. Specifically, inflation in the food and beverage category was reported at 5.21%, while non-food and service category inflation stood at 4.14%.

Remittances Inflows

Remittance inflows surged by 19.8% to Rs. 1082.62 billion, a growth rate slightly lower than the 24.2% increase observed in the same period of the previous year. In US Dollar terms, remittance inflows increased by 17.7% to $8.15 billion, compared to a 13.9% increase in the same period of the previous year.

Similarly, the number of Nepali workers, including both institutional and individual, obtaining first-time approval for foreign employment stood at 329,422, while those obtaining approval for re-entry totaled 212,721. In the previous year, these figures were 387,839 and 217,959 respectively.

Foreign Exchange Reserves and Adequacy Indicators

The gross foreign exchange reserves experienced a notable surge, increasing by 24.2% to Rs. 1911.86 billion from Rs. 1539.36 billion in mid-July 2023. Similarly, in US dollar terms, these reserves saw a 22.7% rise to $14.36 billion from $11.71 billion in mid-July.

Based on the imports data for the first nine months of 2023/24, the foreign exchange reserves held by the banking sector are deemed sufficient to cover prospective merchandise imports for 15 months, as well as merchandise and services imports for 12.5 months.

Margin Nature Loan

The Nepal Rastra Bank has noted a slight uptick in marginal nature loans, rising to 86.185 Arba by mid-April from 76.308 Arba in mid-July 2023, marking a 12.9% increase over the span of nine months in the current fiscal year.

The data highlights a significant increase in loans exceeding Rs 1 crore, showing a 17.7% surge, alongside a modest 2% rise in loans ranging from Rs 50 lakh to Rs 1 crore. This underscores the growing inclination towards larger loan amounts among investors. Notably, loans surpassing Rs 1 crore have escalated from Rs 44.716 Arba to Rs 52.613 Arba over a nine-month period. Furthermore, loans falling within the range of Rs 25 lakh to Rs 50 lakh have experienced an 11% increase, while loans below Rs 25 lakh have also observed a 4.9% uptick.

Current Account and Balance of Payments

The current account maintained a surplus of Rs. 179.48 billion, a significant turnaround from the deficit of Rs. 60.43 billion in the same period of the previous year. In US Dollar terms, the current account showed a surplus of $1.35 billion, in contrast to the deficit of $468.3 million in the corresponding period last year.

Similarly, the Balance of Payments (BOP) also stayed in surplus, reaching Rs. 365.16 billion compared to Rs. 174.28 billion in the same period of the previous year. In US Dollar terms, the BOP surplus was $2.75 billion, an increase from $1.32 billion in the corresponding period of the previous year.

Import and Export

Merchandise exports saw a 3.7% decrease to Rs. 113.95 billion, a significant improvement from the 26.3% drop in the same period the previous year. While exports to India and other nations declined, exports to China notably surged by 232%. Exports of zinc sheet, particle board, juice, polyester yarn and thread, and ready-made garments, among other items, saw increases, while exports of palm oil, soybean oil, woolen carpets, tea, jute goods, and other commodities experienced declines.

In contrast, merchandise imports for the nine months of 2023/24 decreased by 2.8% to Rs. 1167.37 billion, a less severe drop compared to the previous year's 18.1% decrease. Imports from India and other countries decreased, while imports from China rose significantly by 33.4%. Imports of transport equipment, vehicles and their spare parts, ready-made garments, aircraft spare parts, electrical equipment, textiles, and other items have increased. Conversely, imports of gold, crude soybean oil, crude palm oil, petroleum products, rice/paddy, and various other goods have decreased.

The total trade deficit narrowed by 2.8% to Rs. 1053.42 billion, compared to a 17.1% decrease in the corresponding period of the previous year. Additionally, the export-import ratio remained at 9.8%.

Exchange Rate

The Nepalese currency depreciated by 1.23% against the US dollar compared to mid-July 2023. This depreciation was less severe than the 2.69% depreciation observed in the same period of the previous year. Specifically, the buying exchange rate per US dollar was Rs. 132.80 in mid-April 2024, up from Rs. 131.17 in mid-July 2023.

Interest Rates

The average base rates for commercial banks, development banks, and finance companies were 8.51%, 10.41%, and 12.02% respectively. This marks a decrease from the average base rate of commercial banks, which was 10.48% in the corresponding month of the previous year.

Additionally, the weighted average deposit rates for commercial banks, development banks, and finance companies were 6.53%, 7.58%, and 8.82% respectively, down from 8.26% for commercial banks a year ago.

Similarly, the weighted average lending rates for commercial banks, development banks, and finance companies were 10.55%, 12.17%, and 13.36% respectively, compared to 12.84% for commercial banks in the corresponding month of the previous year.

Nepal Government Expenditure and Revenue

As per the Ministry of Finance, Financial Comptroller General Office (FCGO), the Nepal Government's total expenditure reached Rs. 909.39 billion during the nine months of 2023/24. This marks a 3.6% decrease compared to the growth of 18.7% in the previous fiscal year. Recurrent expenditure, capital expenditure, and financial expenditure amounted to Rs. 644.03 billion, Rs. 97.38 billion, and Rs. 167.99 billion respectively.

Total revenue mobilization of the Nepal Government, including the amount to be transferred to provincial and local governments, reached Rs. 748.04 billion. This signifies a growth of 9.4% compared to a decrease of 13.4% in the same period of the last fiscal year. Tax revenue amounted to Rs. 671.12 billion, while non-tax revenue stood at Rs. 76.93 billion.

Summary

In summary, the Nepal Rastra Bank's monthly report for the first nine months of fiscal year 2023/24 paints a picture of resilience and growth in the face of various economic challenges. From controlled inflation rates to substantial increases in remittance inflows and foreign exchange reserves, the economy demonstrates its ability to navigate uncertainties. Additionally, the surge in loans, particularly those exceeding Rs 1 crore, reflects confidence and investment potential in the market. Moreover, the surplus in both the current account and balance of payments signifies stability and strength in Nepal's external economic relations. Overall, while there are areas for improvement, the trajectory depicted in the report offers optimism for sustained growth and prosperity in the coming periods.

Get the latest insights on macroeconomic trends by subscribing to our Weekly Newsletter, ensuring you're up-to-date on all economic developments.

Tags:

Economic Trends

Economic Trends

Leave a comment on this post

Comments

Ramnaresh Pandit

Good information

Raj Limbu

Very helpful information 😊 👌

Shyam Lal

👍

Narendra Shahi

very useful

Rajesh Magar

Great 🤗

Jharna Magar

Thank you so much for your information 🙏

Jems Mahat

K

Milan Ghising

👍

Npl

Good

Prakash Singh

Thank you for these useful insights

Dipraj Aacharya

Informative

Related Article

Economics

Reading time : 4 mins

MONTHLY FIXED DEPOSIT RATE MOVEMENT SHRAWAN 2082

Economics

Reading time : 8 mins

Monetary Policy 2082/83: Priorities, Targets, and Implications

Economics

Reading time : 3 mins

From Remittance to Returns: The Nepali Migrant’s Guide to IPO Investment

Economics

Reading time : 8 mins

Nepal Returns to FATF Grey List: What It Means and the Road Ahead

Economics

Reading time : 8 mins

Monetary Policy 2081/82: Key Adjustments and Their Economic Impacts

Economics

Reading time : 8 mins

राष्ट्र बैंक र मौद्रिक नीति

Economics

Reading time : 9 mins

आर्थिक बजेट २०८१/८२: भाषण मात्र की पुनरुत्थान पनि?

Economics

Reading time : 7 mins

बजेट ब्रिफकेसको कथा

Economics

Reading time : 8 mins

Effects of Covid-19 on Nepalese Economy

Economics

Reading time : 7 mins

EVs in Nepal: Status, Sustainability and Challenges

Economics

Reading time : 8 mins

Understanding Our Economy: Highlights from Mid-January 2023/24 Data

Economics

Reading time : 9 mins

Digital Economy and FinTech in Nepal

Economics

Reading time : 8 mins

Microfinance and Poverty Reduction

Economics

Reading time : 6 mins

Nepal's Trade Relations and Economic Diplomacy

Economics

Reading time : 6 mins

The Economic Influence of Tourism in Nepal

Economics

Reading time : 6 mins

The Endless Dance of Debt: Understanding the Dark Side of Finance

Economics

Reading time : 14 mins

Analyzing Economic Indicators: Are We Headed for a Recession?

Economics

Reading time : 10 mins

Inflation: Understanding the Basics

Economics

Reading time : 7 mins

How the Insurance Sector in Nepal is Evolving?

Economics

Reading time : 6 mins

Why Can the Government not Print More Money and Make Everyone Rich?

Economics

Reading time : 7 mins

India's Rice Export Ban and the Potential Global Threat

Economics

Reading time : 13 mins

Are We Ready for a Coin-Less Economy?

Economics

Reading time : 6 mins

Cement Industry in Nepal: An Overview

Economics

Reading time : 12 mins

Major Highlights of Monetary Policy 2080/81

Economics

Reading time : 11 mins

Simplifying Monetary Policy: How Central Banks Regulate the Economy

Economics

Reading time : 7 mins

Nepal’s Public Debt: 1960 and onwards

Economics

Reading time : 9 mins

The Highlights of Budget 2080-2081

Economics

Reading time : 4 mins

The Pegged Currency System: A Close Look at the Nepalese Currency Pegged to the Indian Rupee

Economics

Reading time : 8 mins

Understanding De-Dollarization: Is the supremacy of the US dollar as the global currency at risk?