How terms Bull and Bear coined

How terms Bull and Bear coined

Finance

Ideapreneur Nepal

Created on :

2025-08-10

Download our app for a smooth experience

Total Views:

185 views

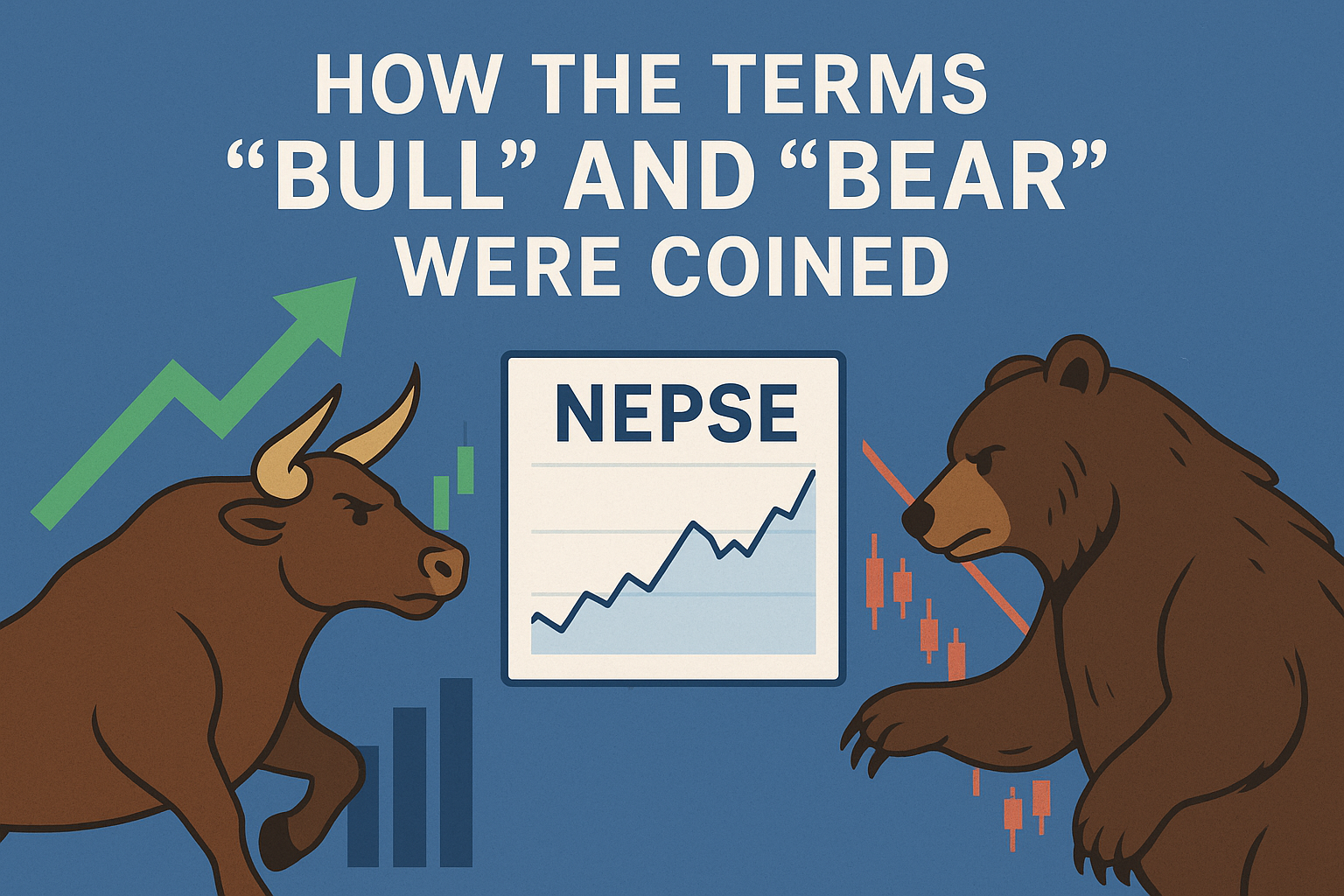

In Nepal's growing financial markets, especially NEPSE (Nepal Stock Exchange), the terms “bull” and “bear” are now common in investor conversations, financial news, and market analysis. But have you ever wondered where these animal terms actually came from, and how they became part of Nepal’s market language?

A bull refers to a market condition where prices of stocks or other securities are rising or expected to rise, usually driven by strong investor confidence, positive economic indicators, and high demand. In a bull market, investors are optimistic about future growth, which leads to increased buying, higher trading volumes, and a general upward trend in the market. The term comes from the way a bull attacks—thrusting its horns upward, symbolizing rising momentum in the market.

A bear signifies a period when the market experiences falling prices, typically by 20% or more from recent highs, often accompanied by fear, pessimism, and widespread selling among investors. In a bear market, economic conditions may be weakening, and investor sentiment turns negative, resulting in declining stock values. The term is inspired by the bear’s natural attack motion—swiping its paws downward, which represents a drop in market direction.

The term “bear” has its roots in an old proverb: "Don’t sell the bear’s skin before you’ve caught the bear." This warning advises against counting on profits before they're secured. It was popular among fur traders and was later adopted to describe speculative financial behavior.In 18th-century Britain, middlemen known as “bearskin jobbers” would sell bearskins they did not yet possess, betting that prices would fall before they had to deliver. This speculative practice mirrored short selling in modern markets. Over time, “bearskin jobber” was shortened to “bear,” and the term came to denote investors expecting or profiting from falling prices. Though the exact origins of “bull” are more elusive, it is widely understood that the term gained prominence by contrast with “bear,” reinforced by popular imagery and language around speculative trading. The use of both terms was solidified in Thomas Mortimer’s 1761 book, Every Man His Own Broker, which recorded the terminology in the context of London’s Exchange Alley.

"A Bull is the name by which the gentlemen of 'Change Alley choose to call all persons who contract to buy any quantity of government securities, without an intention or ability to pay for it, and who consequently are obliged to sell it again, either at a profit or a loss, before the time comes when they have contracted to take it".

This refers to the former practice of stock-brokers, abolished circa 1980's in London, allowing their clients to trade on credit during a period of about two weeks, known as an account, on the completion of which all purchases and sales made during the account period had to be paid for on the settlement date. A net trading loss would result in the client having to make a cash payment to the broker.

In essence, the terms “bull” and “bear” carry centuries of history, evolving from old trading slang in 18th-century London to widely recognized symbols in today’s global financial markets including Nepal’s NEPSE. While a bull embodies optimism and upward momentum, a bear reflects caution and downward pressure. Their colorful origins, rooted in both animal behavior and historical trading practices, give these terms a vivid character that resonates with investors. In Nepal’s fast-developing market, they not only describe market trends but also capture the emotions, strategies, and expectations driving investor behavior making them an enduring part of the country’s financial language.

Tags:

STOCK MARKET

STOCK MARKET

Leave a comment on this post

Comments

Hello World

Nice article

Aalok Gupta

Good one

Kamal

I love it ❤️🤩

Related Article

Finance

Reading time : 5 mins

Fear of Missing Out (FOMO) in Trading

Finance

Reading time : 6 mins

What exactly is euphoria in trading?

Finance

Reading time : 7 mins

What is Short Selling in Stock Market?

Finance

Reading time : 8 mins

Travel Finance 101: Essential Tips for Budget-Friendly Trips

Finance

Reading time : 7 mins

Personal Finance Management: Planning for Retirement at Every Age

Finance

Reading time : 4 mins

IMF to Audit 10 Largest Nepali Banks

Finance

Reading time : 4 mins

Staying Focused in the Chaotic Trading World

Finance

Reading time : 6 mins

Scan and Pay between India and Nepal !

Finance

Reading time : 8 mins

Bitcoin Halving 2024: Price Implications, Market Dynamics, and Historical Context

Finance

Reading time : 12 mins

सेयर धितो कर्जा जता जता; बजार त्यतै त्यतै !!

Finance

Reading time : 7 mins

Are you Revenge Trading? STOP NOW !!!

Finance

Reading time : 5 mins

Desperation Leads to Destruction: Here’s How ?

Finance

Reading time : 8 mins

Struggling to make Buy/Sell Decisions? You might have Analysis Paralysis !!!

Finance

Reading time : 15 mins

बाहिरियो ‘आजियाटा’ : लगानीको वातावरण खराब कि नियत ?

Finance

Reading time : 7 mins

बुक विल्डिंग प्रक्रिया : अब बुझौ सहजै

Finance

Reading time : 9 mins

A Simplified Guide to Book Building Method

Finance

Reading time : 10 mins

Should You Get A Credit Card?

Finance

Reading time : 7 mins

Zero to Million - Yes it's Possible !

Finance

Reading time : 17 mins

नेप्से: अनि उकाली - ओराली

Finance

Reading time : 6 mins

Frugality: An Unpopular Yet Effective Method for Building Wealth

Finance

Reading time : 9 mins

Easy-to-Start Side Hustles for Beginners

Finance

Reading time : 5 mins

10 Practical Budgeting Tips to Help Manage Your Money

Finance

Reading time : 6 mins

Protect Your Financial Future: The Vital Role of an Emergency Fund

Finance

Reading time : 6 mins

Maximizing the Benefits of Loans: A Guide to Strategic Borrowing

Finance

Reading time : 5 mins

Mastering Your Emotions: A Guide to Successful Investing in the Stock Market

Finance

Reading time : 4 mins

NEO BANK CONCEPT